Bundling insurance policies is one of the most common and effective ways to reduce overall insurance costs. Many insurance companies reward customers who purchase multiple policies by offering significant discounts.

This guide explains how insurance bundling works, which policies can be bundled, how much you can realistically save, and when bundling may not be the best option.

1. What Does It Mean to Bundle Insurance Policies

Bundling insurance means purchasing two or more policies from the same insurance company.

Common bundled combinations include:

- Auto and homeowners insurance

- Auto and renters insurance

- Home and umbrella insurance

- Business insurance packages

Insurance companies prefer bundled customers because they are more likely to stay long-term.

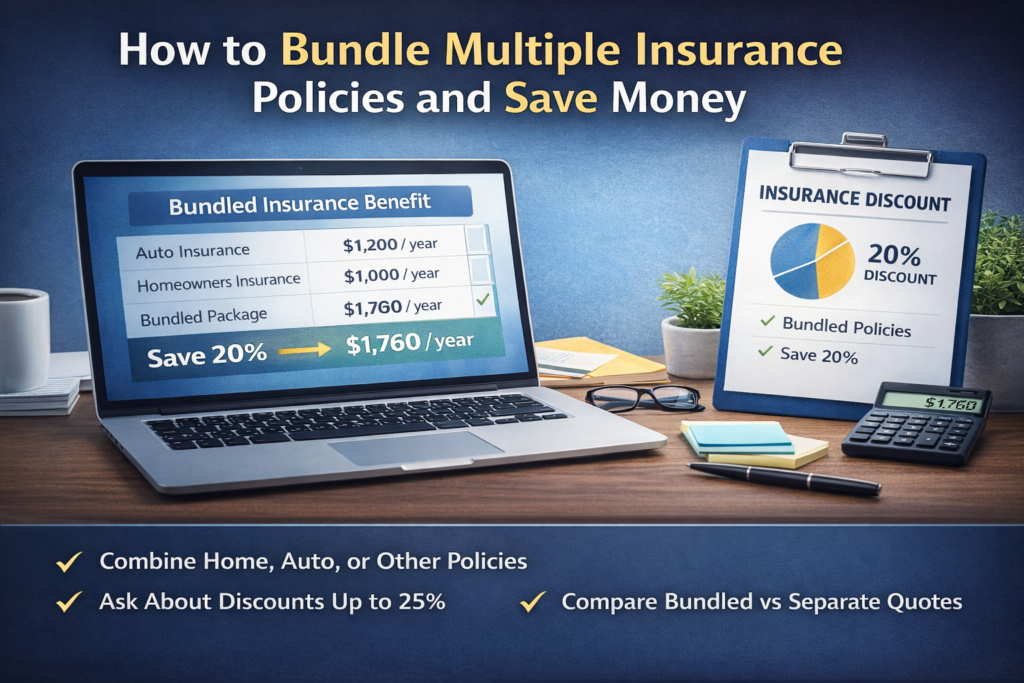

2. How Much Can You Save by Bundling Insurance

Savings from bundling vary depending on the insurer and policies involved.

Typical savings ranges:

- Auto + Home: 10% to 25%

- Auto + Renters: 5% to 15%

- Multiple business policies: up to 30%

The more policies you bundle, the larger the potential discount.

3. Most Common Insurance Bundles Explained

Auto and Home Insurance

This is the most popular bundle. Homeowners often receive the highest discounts when combining these policies.

Auto and Renters Insurance

Renters insurance is inexpensive on its own, but bundling it with auto insurance can still produce meaningful savings.

Home and Umbrella Insurance

An umbrella policy increases liability protection and is often discounted when added to an existing home policy.

Business Insurance Packages

Small businesses frequently bundle general liability, property, and professional liability insurance.

4. Pros of Bundling Insurance Policies

Bundling offers several advantages:

- Lower overall premiums

- One insurance company to manage

- Fewer bills and renewal dates

- Simplified claims process

For many people, convenience is just as valuable as the savings.

5. Cons of Bundling Insurance Policies

Bundling is not always the best option.

Potential downsides include:

- Higher prices for one policy offsetting savings

- Limited flexibility to switch providers

- Weaker coverage in certain areas

Sometimes separate policies from different insurers offer better value.

6. When Bundling Makes Sense

Bundling is usually a good choice if:

- One insurer offers strong coverage for all policies

- The discount is significant

- Customer service and claims handling are reliable

Bundling works best when coverage quality remains high.

7. When You Should Avoid Bundling

Bundling may not be ideal if:

- One policy is overpriced

- Coverage options are limited

- Claims reputation is poor

Always compare bundled and unbundled quotes before deciding.

8. How to Compare Bundled vs Separate Policies

To make the right decision:

- Get bundled quotes

- Get separate quotes from different insurers

- Compare coverage, not just price

- Review deductibles and exclusions

Never assume bundling is automatically cheaper.

9. Tips to Maximize Bundling Discounts

To get the best deal:

- Ask about all available discounts

- Request written quotes

- Review policies annually

- Negotiate before renewal

Insurance pricing changes over time, so regular review is essential.

Call to Action

Compare bundled and separate insurance quotes today and choose the option that offers the best balance of savings, coverage, and reliability.