Identity theft is one of the fastest-growing financial crimes, affecting millions of people each year. Stolen personal information can be used to open credit accounts, file fraudulent tax returns, or drain bank accounts—often without immediate detection. Identity theft insurance is designed to help victims recover financially and restore their identity after fraud occurs. This guide explains how identity theft insurance works, what it covers, and when it’s worth having.

What Is Identity Theft Insurance?

Identity theft insurance is a type of coverage that helps pay for expenses related to recovering your identity after it has been stolen or misused. Unlike traditional insurance, it does not usually reimburse stolen money directly—instead, it covers the cost of recovery.

Coverage is often available as:

A standalone policy

An add-on to homeowners or renters insurance

A feature bundled with credit monitoring services

What Identity Theft Insurance Covers

Recovery Expenses

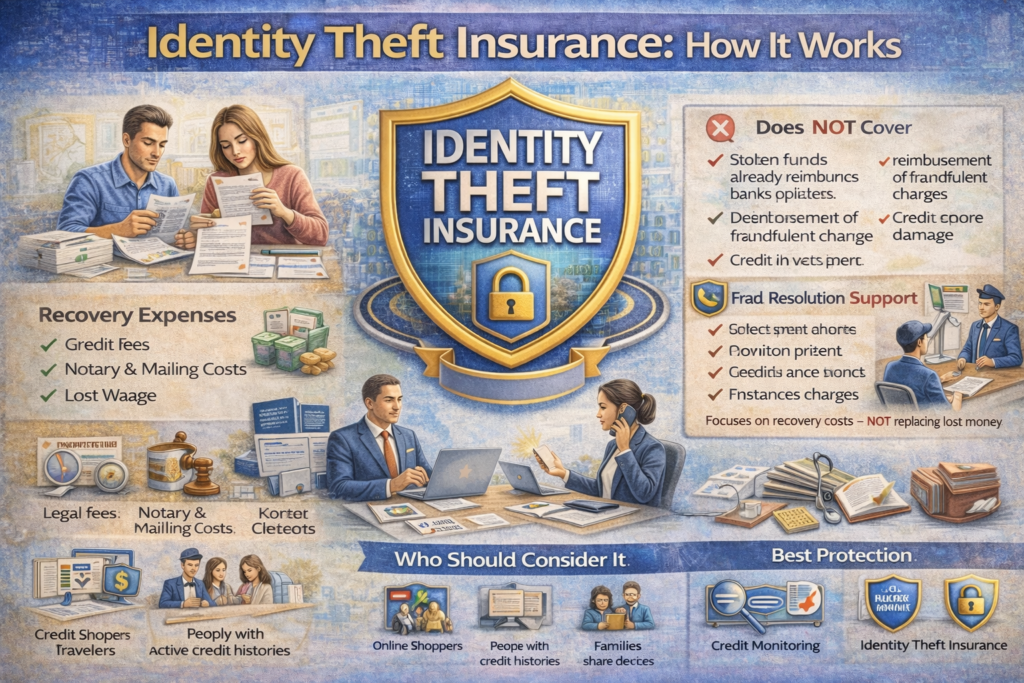

Identity theft insurance typically covers out-of-pocket costs associated with restoring your identity, such as:

Legal fees

Lost wages due to time off work

Notary and mailing costs

Credit report and monitoring fees

Costs to correct records

These expenses can add up quickly without coverage.

Identity Restoration Services

Most policies include access to identity restoration specialists. These professionals help guide you through the recovery process, contact creditors, dispute fraudulent charges, and work with credit bureaus.

This service alone can save dozens of hours and significant stress.

Fraud Resolution Support

If your identity is used to commit fraud, insurance may provide:

Assistance filing police reports

Help contacting financial institutions

Support during disputes with creditors

Guidance through government agencies

This support is especially valuable during complex or long-lasting cases.

What Identity Theft Insurance Does NOT Cover

It’s important to understand the limitations. Identity theft insurance usually does not cover:

Stolen funds already reimbursed by banks

Direct reimbursement of fraudulent charges

Emotional distress or credit score damage

Fraud caused by intentional sharing of information

Business identity theft (unless specifically included)

Coverage focuses on recovery costs—not replacing lost money.

How Identity Theft Insurance Claims Work

If you suspect identity theft:

Report the fraud immediately to your insurer

Submit documentation such as police reports or affidavits

Work with an assigned identity restoration specialist

Track covered expenses related to recovery

Reimbursement is typically issued after expenses are verified.

How Much Coverage Do You Need?

Coverage limits vary by policy, commonly ranging from tens of thousands of dollars. Higher limits may be appropriate if you:

Have significant financial assets

Frequently share information online

Travel often

Run a business or manage complex finances

For many individuals, moderate limits are sufficient due to included restoration services.

Identity Theft Insurance vs Credit Monitoring

Credit monitoring alerts you to suspicious activity but does not help pay for recovery costs. Identity theft insurance often includes monitoring plus financial and professional support.

The best protection usually combines both monitoring and insurance.

Who Should Consider Identity Theft Insurance?

Identity theft insurance is especially useful for:

People with active credit histories

Online shoppers and frequent travelers

Families sharing personal devices

Individuals who want hands-on recovery support

While anyone can benefit, those with more financial complexity face higher risk.

Common Misconceptions About Identity Theft Insurance

“It prevents identity theft”

“It replaces stolen money”

“Banks handle everything”

“Only wealthy people need it”

In reality, identity theft insurance helps after theft occurs and reduces recovery burden—not risk itself.

How to Choose the Right Policy

Check coverage limits and exclusions

Confirm restoration services are included

Understand reimbursement vs assistance

Review claim procedures

Compare bundled options vs standalone policies

Choosing a policy with strong restoration support is often more valuable than high reimbursement limits.

Final Thoughts

Identity theft insurance doesn’t stop fraud—but it makes recovery faster, easier, and far less expensive. In a world where personal data is constantly at risk, having professional support and financial protection after identity theft can make a major difference.

The true value of identity theft insurance isn’t just money—it’s time, guidance, and peace of mind.