Many drivers believe that “full coverage” auto insurance means they’re protected against every possible situation. In reality, full coverage is not a single policy and it does not cover everything. Understanding what full coverage actually includes—and what it doesn’t—can help you avoid costly surprises after an accident or loss.

This guide breaks down what full coverage auto insurance really covers, who needs it, and when it may or may not be worth the cost.

What Is Full Coverage Auto Insurance?

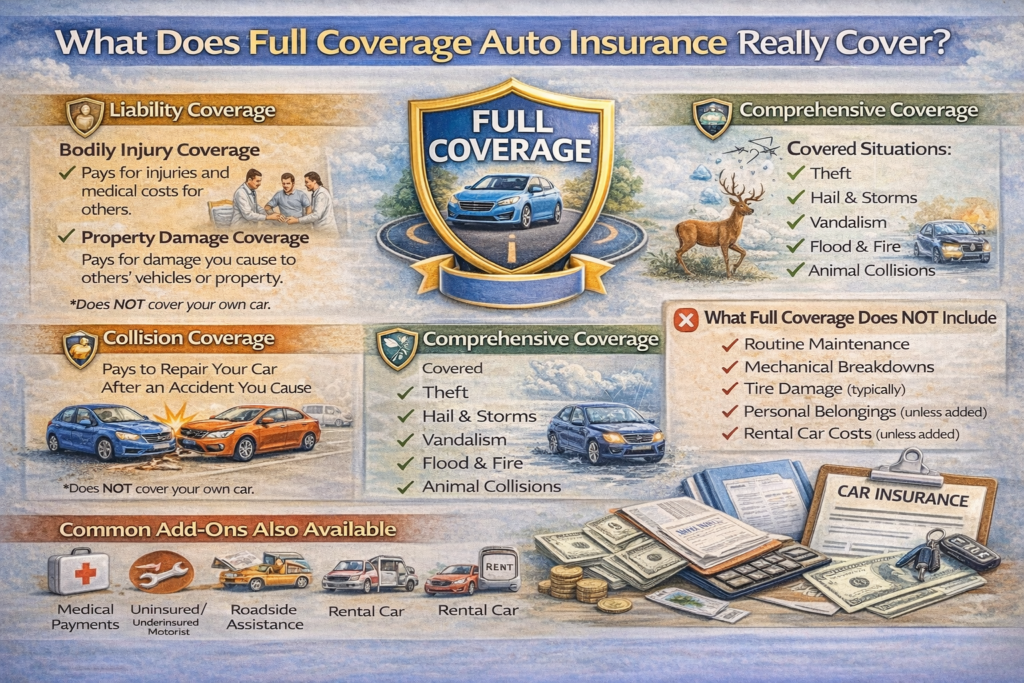

Full coverage auto insurance is a term used to describe a combination of coverages, not a standalone policy. It typically includes:

Liability insurance

Collision coverage

Comprehensive coverage

Together, these coverages protect both other people and your own vehicle.

Liability Coverage: Protection for Others

Liability insurance is required by law in most states and is always part of full coverage.

It includes:

Bodily injury liability – pays for medical bills, lost wages, and legal costs if you injure someone

Property damage liability – pays for damage you cause to another person’s vehicle or property

Important: Liability coverage does NOT pay to repair your own car.

Collision Coverage: Damage From Accidents

Collision coverage pays to repair or replace your vehicle if it’s damaged in a collision, regardless of who is at fault.

Covered situations include:

Crashes with another vehicle

Hitting an object (pole, fence, guardrail)

Single-car accidents

Rollover accidents

A deductible applies, meaning you pay part of the cost before insurance pays the rest.

Comprehensive Coverage: Non-Collision Damage

Comprehensive coverage protects your vehicle from damage that is not caused by a collision.

It typically covers:

Theft

Vandalism

Fire

Hail, storms, and flooding

Falling objects (trees, debris)

Animal strikes

Like collision, comprehensive coverage also has a deductible.

What Full Coverage Does NOT Include

Despite the name, full coverage does not cover everything. Common exclusions include:

Routine maintenance and wear and tear

Mechanical breakdowns

Tire damage (unless caused by a covered event)

Personal belongings inside the car

Medical expenses for you (unless you have separate coverage)

Rental cars (unless added)

Additional coverage is required for these risks.

Optional Coverages Often Added to Full Coverage

Many drivers enhance full coverage with optional add-ons:

Medical payments or personal injury protection

Uninsured/underinsured motorist coverage

Rental reimbursement

Roadside assistance

Gap insurance (for financed or leased vehicles)

These are not automatically included but can significantly improve protection.

When Full Coverage Makes Sense

Full coverage is usually recommended if:

Your car is new or high-value

You are leasing or financing your vehicle

You cannot afford to replace your car out of pocket

You live in an area with high theft or severe weather

Lenders typically require full coverage until the loan is paid off.

When Full Coverage May Not Be Worth It

Full coverage may not make financial sense if:

Your car is older with low market value

The annual premium is close to the car’s value

You have sufficient savings to replace the vehicle

In these cases, liability-only coverage may be more cost-effective.

How Deductibles Affect Full Coverage

Collision and comprehensive coverage both include deductibles. Choosing higher deductibles lowers your premium but increases out-of-pocket costs when filing a claim.

Your deductible choice should match your emergency savings—not just premium goals.

Common Misconceptions About Full Coverage

“Full coverage means everything is covered”

“My insurance will replace personal items stolen from my car”

“I don’t need to review coverage once my loan is paid off”

“All full coverage policies are the same”

Understanding these myths helps prevent denied claims and financial shock.

How to Know If You Have Full Coverage

Check your declarations page. If you see:

Liability coverage

Collision coverage

Comprehensive coverage

Then you have what insurers typically call full coverage.

Final Thoughts

Full coverage auto insurance provides strong protection—but it’s not unlimited or all-inclusive. It covers damage to your vehicle from accidents and non-collision events, while liability protects others.

The key is knowing exactly what’s included, what’s excluded, and whether the cost makes sense for your car and financial situation.

Smart coverage isn’t about having “full coverage”—it’s about having the right coverage.