College life often means living away from home for the first time—whether in a dorm, shared apartment, or off-campus housing. Laptops, phones, bikes, furniture, and personal items can add up to thousands of dollars in value. Renters insurance for college students is an affordable way to protect those belongings and avoid financial stress when accidents or theft occur.

Do College Students Really Need Renters Insurance?

Many students assume they don’t need insurance because they don’t own expensive furniture or because they live in a dorm. In reality, students are at higher risk for theft, accidental damage, and liability claims due to shared living spaces and frequent visitors.

Renters insurance provides protection that parents’ homeowners insurance may not fully cover.

Does Parents’ Insurance Cover College Students?

In some cases, a parent’s homeowners insurance may extend limited coverage to a student living in a dorm. However, this coverage is often restricted and may not apply to off-campus housing.

Common limitations include:

Lower coverage limits

No liability protection for off-campus apartments

Exclusions for roommates’ damage

Higher deductibles

A separate renters insurance policy offers clearer and more reliable protection.

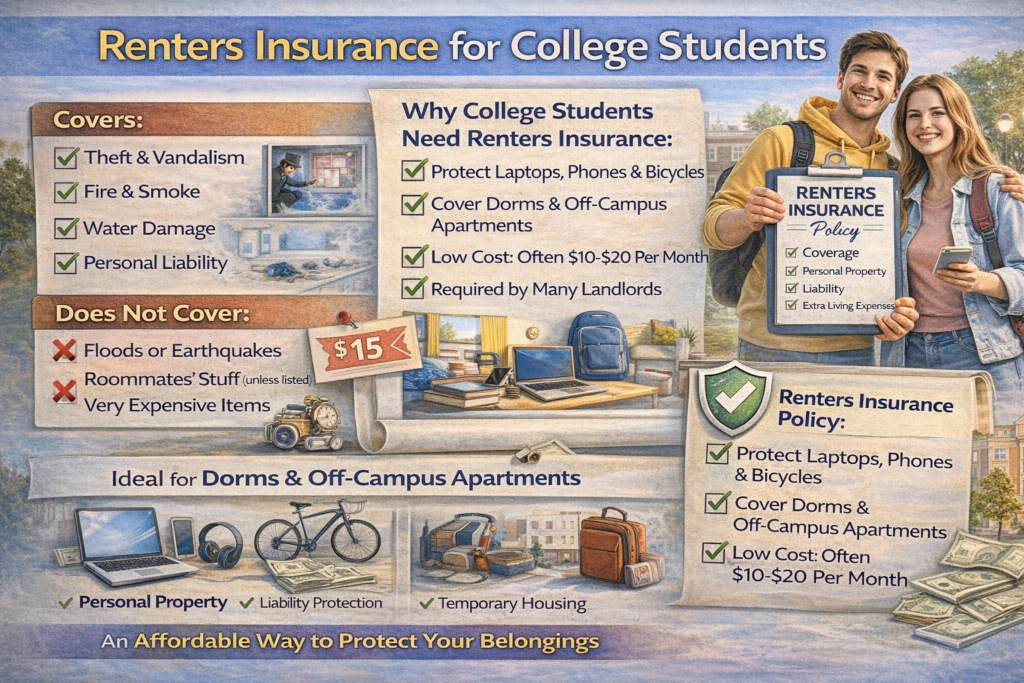

What Renters Insurance Covers for Students

Personal Property Coverage

This covers belongings such as:

Laptops and tablets

Smartphones

Clothing and shoes

Furniture

Textbooks and electronics

Coverage often applies even if items are stolen from a car, library, or coffee shop.

Liability Protection

Liability coverage protects students if someone is injured in their apartment or if they accidentally damage property belonging to others—such as water damage affecting neighboring units.

This is especially important in shared housing situations.

Additional Living Expenses

If a covered event makes the apartment uninhabitable, renters insurance may cover temporary housing and meal costs while repairs are made.

What Renters Insurance Does Not Cover

Renters insurance usually excludes:

Flood and earthquake damage

Intentional damage

Roommates’ belongings (unless listed)

Very high-value items beyond policy limits

Understanding exclusions helps avoid denied claims.

Renters Insurance for Dorms vs Off-Campus Housing

Dorm residents may have limited coverage through parents’ policies, but coverage gaps are common. Off-campus renters are typically required by landlords to carry their own renters insurance.

A personal policy ensures consistent protection regardless of where the student lives.

How Much Does Renters Insurance Cost for Students?

Renters insurance is one of the most affordable types of insurance. Many student policies cost only a few dollars per month, depending on coverage limits and location.

The cost is minimal compared to replacing stolen electronics or paying out of pocket for liability claims.

How to Choose the Right Policy

Estimate the value of your belongings

Choose adequate liability limits

Select a manageable deductible

Check coverage for electronics

Compare multiple providers

Some insurers offer discounts for bundling with auto insurance or for maintaining good academic standing.

Common Mistakes Students Make

Assuming parents’ insurance is enough

Underestimating the value of electronics

Ignoring liability coverage

Not updating coverage after moving

Sharing a policy without listing roommates

Avoiding these mistakes ensures real protection.

Final Thoughts

Renters insurance for college students is a simple, affordable safeguard against common risks of student life. From stolen laptops to accidental damage, the right policy protects both finances and peace of mind—allowing students to focus on school instead of unexpected expenses.

For most students, renters insurance isn’t just a smart choice—it’s essential.