Choosing between liability-only and full coverage auto insurance is one of the most important decisions drivers make. The right choice affects not only your monthly premium but also how much financial risk you carry after an accident. Understanding the real differences helps you avoid underinsurance—or paying for coverage you don’t need.

What Is Liability Auto Insurance?

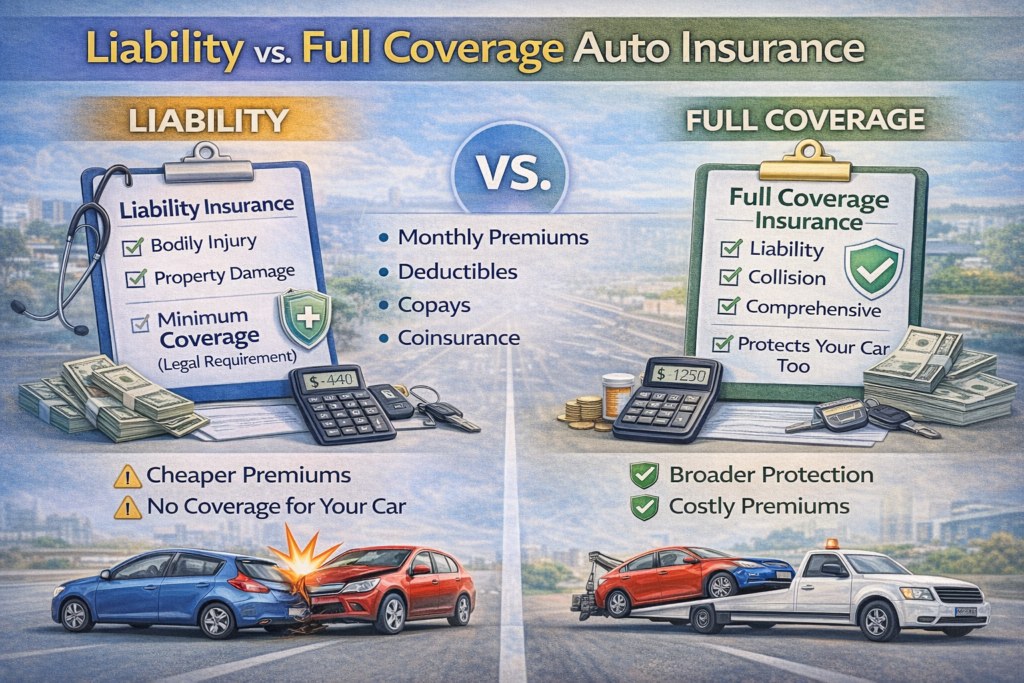

Liability insurance is the minimum coverage required by law in most states. It covers damages you cause to other people but does not cover your own vehicle.

Liability insurance includes:

Bodily injury liability – pays for medical expenses, lost wages, and legal costs for others

Property damage liability – pays for damage to another person’s vehicle or property

If you cause an accident, liability insurance protects others, not you.

What Is Full Coverage Auto Insurance?

Full coverage is not a single policy—it’s a combination of coverages that protect both you and others.

Full coverage typically includes:

Liability insurance

Collision coverage – pays to repair or replace your car after an accident, regardless of fault

Comprehensive coverage – covers non-collision damage such as theft, vandalism, fire, weather, or animal strikes

Full coverage offers broader financial protection but comes at a higher cost.

Key Differences Between Liability and Full Coverage

Liability insurance is designed to meet legal requirements and minimize upfront costs. It does not help repair or replace your own car.

Full coverage provides protection for your vehicle and is often required if you lease or finance your car.

Liability is cheaper but exposes you to greater financial risk. Full coverage costs more but reduces out-of-pocket expenses after accidents or unexpected events.

When Liability Insurance May Be Enough

Liability-only insurance can make sense if:

Your car is older and has low market value

You can afford to replace your vehicle out of pocket

You drive infrequently

You want the lowest possible premium

If the cost of full coverage exceeds the value of your car, liability may be the practical choice.

When Full Coverage Is the Better Option

Full coverage is usually the smarter choice if:

Your car is new or expensive

You are leasing or financing the vehicle

You cannot afford major repair or replacement costs

You live in an area with high theft, vandalism, or weather risk

Lenders almost always require full coverage to protect their investment.

Cost Comparison: Liability vs Full Coverage

Liability insurance typically costs significantly less per month. Full coverage premiums are higher because insurers take on more risk.

However, a single accident without full coverage can cost far more than years of higher premiums. Cost should be weighed against potential financial exposure.

Deductibles and Their Role

Full coverage policies include deductibles for collision and comprehensive claims. Choosing a higher deductible lowers your premium but increases out-of-pocket costs when filing a claim.

Liability-only policies do not have deductibles because they don’t cover your vehicle.

Common Mistakes Drivers Make

Choosing liability only to save money without understanding the risk

Keeping full coverage on a car worth less than the premium cost

Not adjusting coverage after paying off a vehicle

Assuming “full coverage” means everything is covered

Ignoring state minimum liability limits

Avoiding these mistakes ensures your coverage matches your real needs.

How to Decide What’s Right for You

Ask yourself:

What is my car worth today?

Could I afford to replace it tomorrow?

Do I have savings for unexpected losses?

Is my car financed or leased?

How much risk am I comfortable taking?

Your answers determine whether liability or full coverage makes sense.

Final Thoughts

Liability and full coverage auto insurance serve very different purposes. Liability keeps you legal and protects others. Full coverage protects your vehicle and your financial stability.

The best choice balances cost, risk, and peace of mind—not just the lowest premium.