Choosing between term life and whole life insurance is one of the most common decisions people face when buying life insurance. Both options provide financial protection, but they serve very different purposes and come with different costs.

This guide explains the key differences between term life and whole life insurance, how each works, and how to decide which option is best for your situation.

1. What Term Life Insurance Is

Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years.

If the insured person passes away during the term, the policy pays a death benefit to the beneficiaries. If the term ends and the insured is still alive, the coverage expires unless the policy is renewed or converted.

2. What Whole Life Insurance Is

Whole life insurance provides lifetime coverage as long as premiums are paid.

In addition to the death benefit, whole life insurance includes a cash value component that grows over time. This cash value can be borrowed against or accessed under certain conditions.

3. Cost Differences Between Term and Whole Life

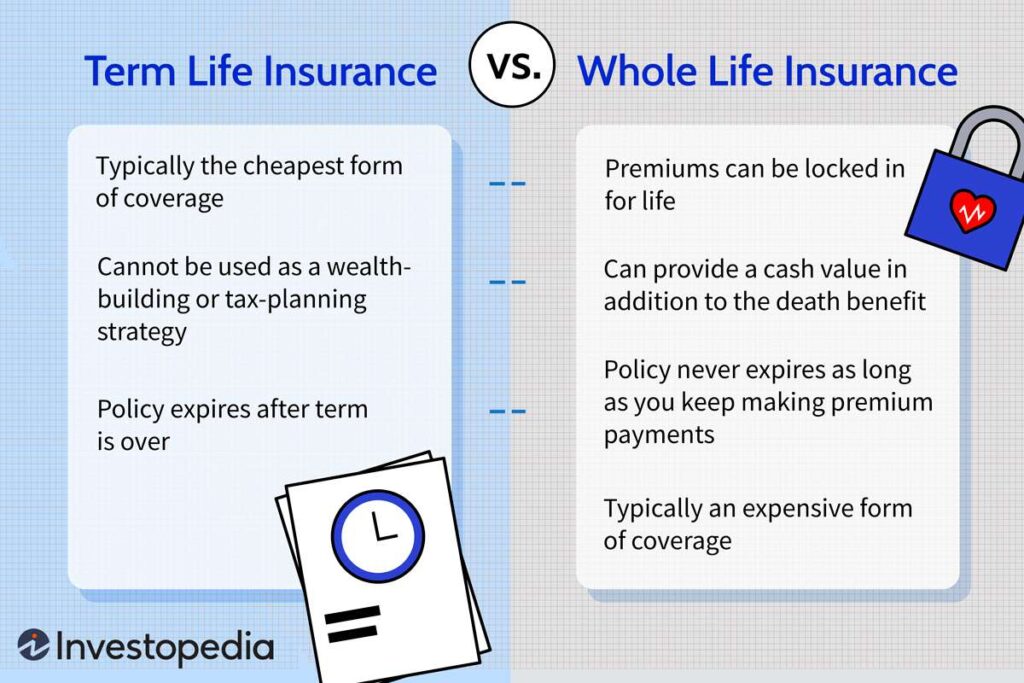

The biggest difference between term and whole life insurance is cost.

Term life insurance is significantly more affordable, especially for younger and healthier individuals. Whole life insurance premiums are much higher and can be several times the cost of term life for the same coverage amount.

4. Coverage Duration and Purpose

Term life insurance is best suited for temporary financial needs.

Common uses include income replacement, mortgage protection, and covering expenses while children are financially dependent. Whole life insurance is designed for permanent needs such as estate planning, long-term financial security, and guaranteed inheritance.

5. Cash Value: Benefits and Limitations

Whole life insurance builds cash value over time on a tax-deferred basis.

This feature can provide flexibility, but cash value growth is slow in the early years and comes at the cost of higher premiums. Term life insurance does not build cash value and focuses solely on protection.

6. Flexibility and Simplicity

Term life insurance is simple and easy to understand.

Whole life insurance is more complex due to cash value, loans, and long-term commitments. Some people value the simplicity of term life, while others prefer the added features of whole life.

7. Who Term Life Insurance Is Best For

Term life insurance may be the better choice if you want affordable coverage, have a limited budget, need protection for a specific period, or prefer straightforward insurance without investment components.

8. Who Whole Life Insurance Is Best For

Whole life insurance may be suitable if you want lifetime coverage, have long-term estate planning goals, can afford higher premiums, and value guaranteed benefits and cash value accumulation.

9. Common Mistakes When Choosing Life Insurance

Many people make mistakes such as buying more insurance than needed, choosing whole life without understanding the cost, or selecting term coverage that is too short.

Understanding your financial goals and obligations helps avoid these errors.

10. How to Decide What’s Best for You

The best life insurance choice depends on your income, family responsibilities, long-term goals, and budget.

Comparing quotes and understanding how each policy fits into your financial plan is the most effective way to make the right decision.

Call to Action

Compare term life and whole life insurance options today and choose the policy that best protects your family and financial future.