Life insurance is often seen as something you buy later in life—after marriage, kids, or buying a home. But starting life insurance early can be one of the smartest financial decisions young adults make. Lower costs, better coverage options, and long-term financial flexibility are just a few of the reasons why buying life insurance at a young age pays off.

This guide explains why life insurance matters for young adults and how starting early creates long-term advantages.

Why Young Adults Overlook Life Insurance

Many young adults believe they don’t need life insurance because:

They have no dependents

They are healthy

They have limited financial obligations

They want to focus on short-term expenses

While these assumptions are common, they often ignore how life insurance fits into long-term financial planning.

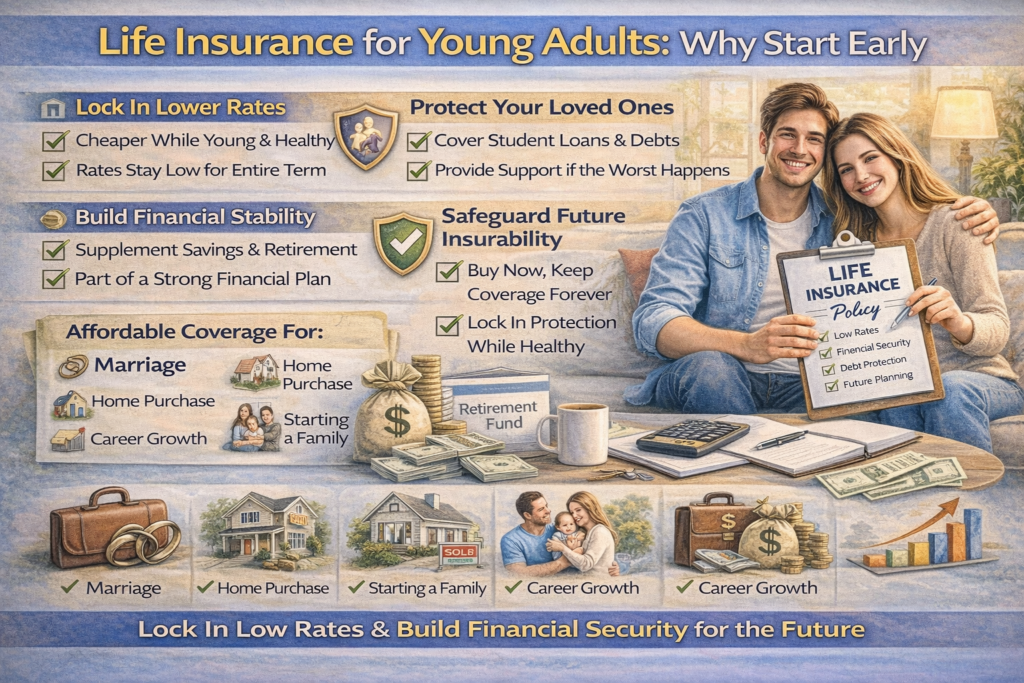

The Biggest Advantage: Lower Premiums

Life insurance premiums are largely based on age and health. The younger and healthier you are, the less you pay.

Locking in a policy early allows you to secure low rates that remain fixed for the entire policy term. Waiting even a few years can significantly increase costs—sometimes permanently.

Health Matters More Than You Think

Life insurance eligibility and pricing depend heavily on health. Unexpected medical conditions can arise at any age.

Buying life insurance while you’re young and healthy protects you from future health-related exclusions, higher premiums, or denial of coverage altogether.

Life Insurance Isn’t Just for Dependents

Even without children or a spouse, life insurance can still play an important role.

It can help cover:

Student loans with co-signers

Personal debts

Funeral and final expenses

Financial support for parents or siblings

Life insurance prevents loved ones from inheriting financial burdens.

Term Life Insurance: Ideal for Young Adults

For most young adults, term life insurance is the best option. It offers affordable coverage for a set period—commonly 20 or 30 years.

Term life insurance provides high coverage amounts at low cost, making it ideal for early career stages and future family planning.

Building a Strong Financial Foundation

Life insurance complements other financial tools such as:

Emergency savings

Retirement accounts

Disability insurance

It adds a layer of financial protection that supports long-term stability, especially as responsibilities grow.

Protecting Future Insurability

Once you own a policy, future changes in health won’t affect that coverage. This is especially valuable if you plan to:

Start a family

Buy a home

Launch a business

Early coverage guarantees protection when life becomes more complex.

Life Events That Make Early Insurance Even Smarter

Buying early is especially beneficial if you anticipate:

Marriage

Children

Homeownership

Career growth

Entrepreneurship

Having coverage already in place avoids rushed decisions later.

How Much Life Insurance Do Young Adults Need?

Coverage should reflect:

Current debts

Future income potential

Long-term goals

Family support responsibilities

Many young adults are surprised how affordable substantial coverage can be when purchased early.

Common Mistakes Young Adults Make

Waiting until life insurance feels “necessary”

Assuming employer-provided insurance is enough

Buying too little coverage

Ignoring future financial responsibilities

Not reviewing policies as life changes

Avoiding these mistakes creates lasting financial protection.

Final Thoughts

Life insurance for young adults isn’t about expecting the worst—it’s about planning smart. Starting early locks in low rates, protects future insurability, and builds a stronger financial foundation.

The best time to buy life insurance isn’t when you need it—it’s when you’re healthiest and least expensive to insure.