Flooding is one of the most common and costly natural disasters, yet it’s also one of the most misunderstood when it comes to insurance. Many homeowners and renters assume flood damage is covered by standard insurance policies—only to find out after a loss that it isn’t. This article helps you determine whether flood insurance is truly necessary for your situation and what risks you may be overlooking.

What Is Flood Insurance?

Flood insurance is a separate policy designed to cover damage caused by flooding. Flooding is defined as excess water on normally dry land, such as overflow from rivers, storm surge, heavy rainfall accumulation, or rapid snowmelt.

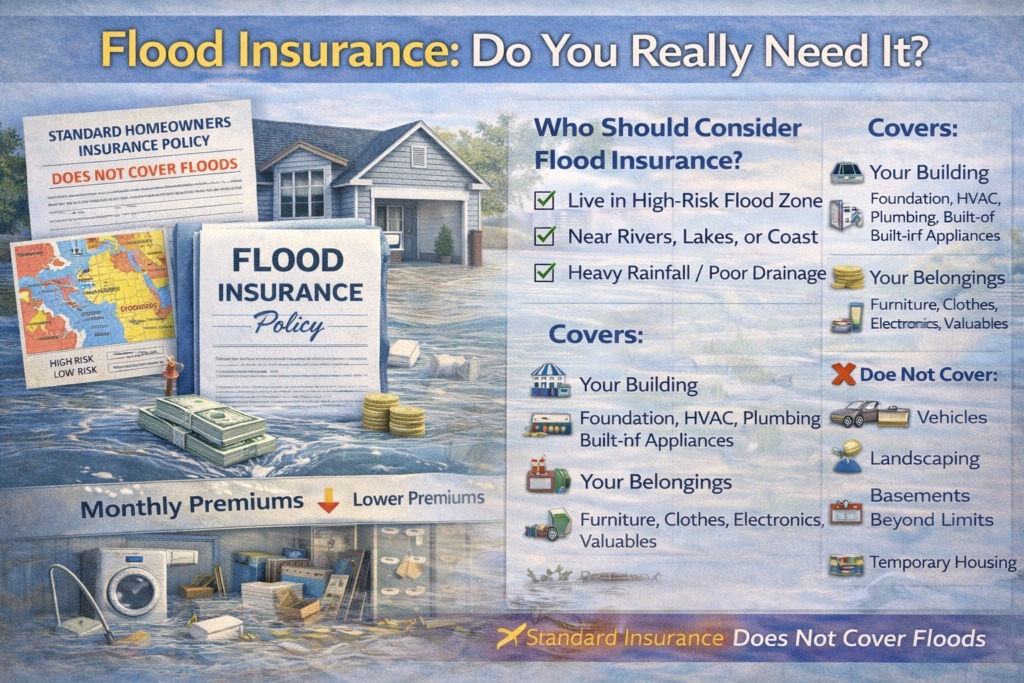

Standard homeowners and renters insurance do not cover flood damage, regardless of the cause.

Why Flood Damage Is Usually Excluded

Flood damage is excluded from standard policies because it often affects many properties at once, creating extremely high losses. Insurers manage this risk separately through dedicated flood insurance programs.

This means even water damage from a severe storm may be excluded if it’s classified as flooding rather than wind-driven rain.

Who Needs Flood Insurance?

Flood insurance is essential for some people and still highly recommended for others.

You likely need flood insurance if:

You live in a high-risk flood zone

Your mortgage lender requires it

Your home is near rivers, lakes, or coastal areas

Your area experiences heavy rainfall or poor drainage

You should strongly consider flood insurance even if:

You live in a moderate- or low-risk zone

Your property has never flooded before

Your home is on higher ground

A significant portion of flood claims come from areas considered low or moderate risk.

Flood Zones and Risk Levels

Flood zones are determined by flood maps that estimate the likelihood of flooding. High-risk zones have the greatest chance of flooding, but low-risk zones are not flood-proof.

Flood maps can change over time due to development, climate patterns, and infrastructure changes. Past flooding is not the only indicator of future risk.

What Flood Insurance Typically Covers

Flood insurance policies usually include two main types of coverage:

Building Coverage

This covers the structure of your home, including:

Foundation and walls

Electrical and plumbing systems

HVAC equipment

Built-in appliances

Contents Coverage

This covers personal belongings such as:

Furniture and electronics

Clothing

Appliances

Certain valuables

Contents coverage is often optional for homeowners and renters.

What Flood Insurance Does Not Cover

Flood insurance typically does not cover:

Temporary housing expenses

Landscaping and outdoor property

Vehicles

Currency, precious metals, or most valuables

Basements beyond specific limits

Understanding these limitations is essential when evaluating coverage.

How Much Does Flood Insurance Cost?

Flood insurance costs depend on:

Flood zone classification

Home elevation and structure

Coverage limits

Deductibles

Policies in low-risk areas are often more affordable than expected. Waiting until flooding is imminent is not an option—there is usually a waiting period before coverage begins.

Common Misconceptions About Flood Insurance

“I’m not in a flood zone, so I don’t need it”

“My homeowners insurance will cover it”

“My area has never flooded before”

“It’s too expensive”

These assumptions often lead to devastating financial losses after a flood.

Renters and Flood Insurance

Renters are not protected from flood damage by a landlord’s insurance. A renter’s flood insurance policy can cover personal belongings damaged by flooding, offering affordable protection against a major loss.

When Flood Insurance Makes the Most Sense

Flood insurance is most valuable when:

Your home represents a large portion of your net worth

You cannot afford to self-insure flood losses

You live in an area with increasing extreme weather

You want certainty and peace of mind

The cost of insurance is often small compared to the cost of flood recovery.

Final Thoughts

Flood insurance isn’t just for high-risk zones—it’s for anyone who wants protection from one of the most common and expensive disasters. Standard insurance leaves a critical gap, and flood damage can happen almost anywhere.

The real question isn’t “Will it flood?”—it’s “Can I afford it if it does?”