When a business is forced to shut down temporarily, the financial damage often goes far beyond physical repairs. Lost income, ongoing expenses, and disrupted operations can threaten survival—especially for small and mid-sized businesses. Business interruption insurance is designed to cover these hidden losses, but many business owners don’t realize whether they need it until it’s too late.

This guide explains what business interruption insurance covers, who needs it most, and how to decide if it’s right for your business.

What Is Business Interruption Insurance?

Business interruption insurance (also called business income insurance) covers lost income and operating expenses when your business cannot operate due to a covered event.

It typically activates when physical damage from a covered peril—such as fire, storm, or vandalism—forces your business to close or significantly reduce operations.

This coverage is usually included as part of a commercial property policy or business owners policy, rather than sold as a standalone policy.

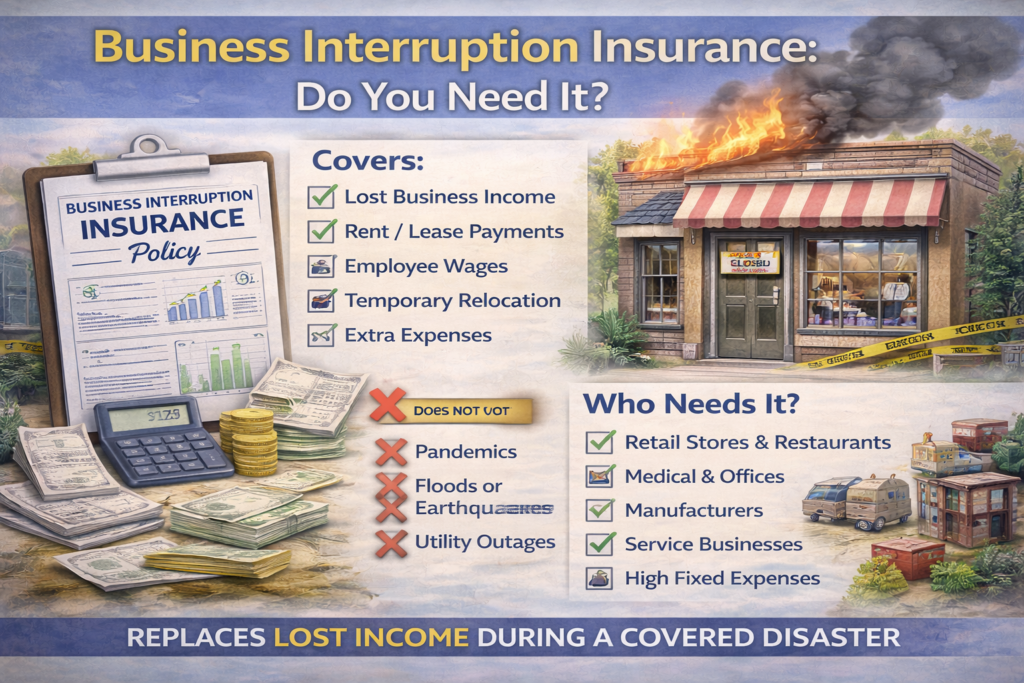

What Business Interruption Insurance Covers

Lost Business Income

The core purpose of this insurance is to replace income your business would have earned if the interruption had not occurred. This is based on historical financial records, not projected growth.

Ongoing Operating Expenses

Even when closed, many expenses continue. Coverage may include:

Rent or mortgage payments

Employee wages

Utilities

Loan payments

Taxes

This helps prevent cash flow collapse during downtime.

Temporary Relocation Costs

If your business must move to a temporary location to continue operations, business interruption insurance may cover relocation and setup expenses.

Extra Expenses

Extra expense coverage pays for reasonable costs incurred to reduce downtime, such as expedited repairs, temporary equipment, or alternative suppliers.

Civil Authority Coverage

If a government order forces your business to close due to nearby damage (for example, evacuation orders or restricted access), some policies provide limited coverage—even if your property is not directly damaged.

What Business Interruption Insurance Does NOT Cover

Understanding exclusions is critical. Most policies do not cover:

Pandemics or viruses (unless explicitly endorsed)

Flood or earthquake damage without separate policies

Utility outages away from your property

Supplier or customer shutdowns unless contingent coverage is added

Losses due to poor maintenance or negligence

Coverage only applies if the underlying cause is covered under your property policy.

How Long Does Coverage Last?

Coverage lasts during the “period of restoration”—the time reasonably required to repair or replace damaged property and resume normal operations.

It does not extend indefinitely, even if customer demand takes longer to recover.

Who Needs Business Interruption Insurance the Most?

Business interruption insurance is especially important for:

Retail stores and restaurants

Manufacturers and warehouses

Medical and professional offices

Service-based businesses with physical locations

Businesses with high fixed expenses

Any business that depends on a physical location to generate income is exposed to interruption risk.

Businesses That Often Underestimate the Risk

Many business owners assume interruptions won’t happen to them, especially if they’ve never filed a claim. However, fires, burst pipes, storms, and vandalism are common causes of forced closures.

Small businesses are often the most vulnerable because they have limited cash reserves to absorb extended downtime.

How Much Business Interruption Coverage Do You Need?

Coverage amounts should be based on:

Annual revenue

Fixed monthly expenses

Payroll obligations

Expected repair timelines

Supply chain dependencies

Underestimating coverage can leave you underinsured, while overestimating increases premiums unnecessarily.

Common Mistakes Business Owners Make

Assuming property insurance covers lost income

Choosing limits without reviewing financial statements

Ignoring civil authority or extra expense coverage

Not updating coverage after business growth

Assuming pandemics are covered

Avoiding these mistakes can be the difference between recovery and permanent closure.

How to Decide If You Need It

Ask yourself:

Could my business survive months without income?

Do I have enough cash reserves to pay fixed expenses?

How quickly could I realistically reopen after a loss?

Would losing customers during downtime harm long-term revenue?

If the answer to any of these raises concern, business interruption insurance is likely essential.

Final Thoughts

Business interruption insurance protects what property insurance cannot—your income, cash flow, and business continuity. While it won’t prevent disasters, it can prevent temporary closures from becoming permanent failures.

For many businesses, the real risk isn’t damage—it’s downtime.