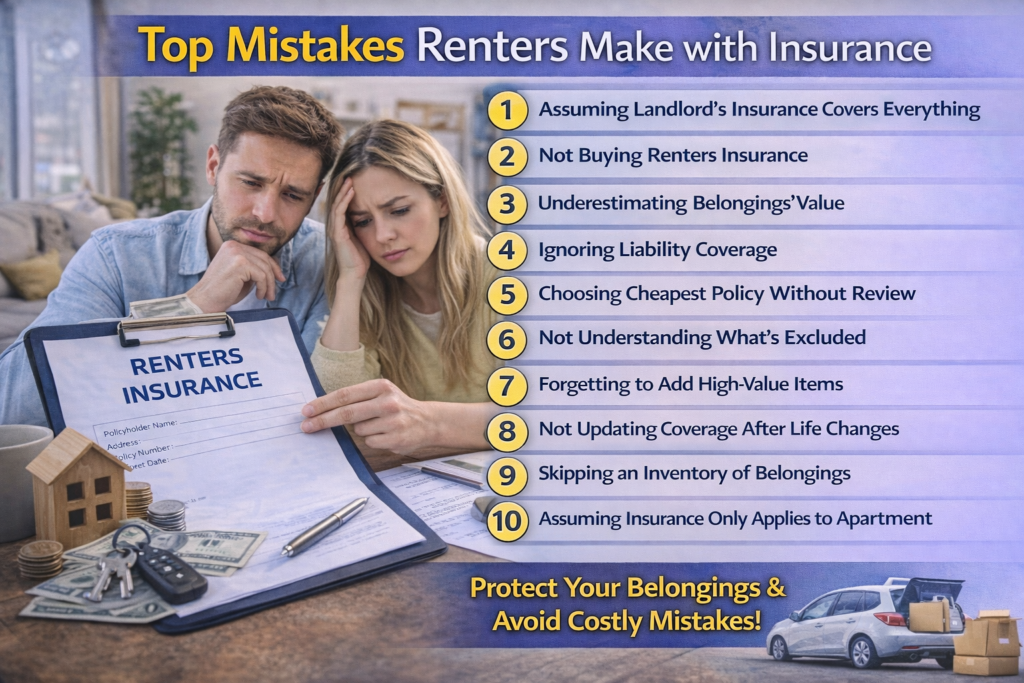

Renters insurance is one of the most affordable types of coverage, yet it’s also one of the most misunderstood. Many renters either skip it entirely or buy a policy that doesn’t truly protect them. These mistakes can lead to major financial losses after theft, accidents, or unexpected events. Below are the most common renters insurance mistakes—and how to avoid them.

1. Assuming the Landlord’s Insurance Covers Everything

One of the biggest misconceptions renters have is believing the landlord’s insurance protects their personal belongings. In reality, a landlord’s policy only covers the building itself.

If your furniture, electronics, clothing, or valuables are damaged or stolen, you are responsible unless you have renters insurance.

2. Not Buying Renters Insurance at All

Some renters skip insurance entirely to save money, not realizing how affordable it actually is. Renters insurance often costs less than a monthly streaming subscription.

Without coverage, even a small incident like a kitchen fire or water damage can result in thousands of dollars in losses.

3. Underestimating the Value of Personal Belongings

Many renters choose low coverage limits because they underestimate how much their belongings are worth. When you add up furniture, electronics, clothing, and household items, the total can be much higher than expected.

Failing to insure belongings at replacement value can leave you paying out of pocket after a claim.

4. Ignoring Liability Coverage

Renters often focus only on personal property and overlook liability protection. Liability coverage protects you if someone is injured in your rental or if you accidentally damage someone else’s property.

Without liability coverage, legal fees and medical bills can become a serious financial burden.

5. Choosing the Cheapest Policy Without Reviewing Coverage

Low-cost policies may come with limited coverage, high deductibles, or strict exclusions. Choosing the cheapest option without reviewing what’s included can lead to denied claims or insufficient payouts.

Affordable insurance is valuable only if it actually protects you.

6. Not Understanding What Is Excluded

Standard renters insurance policies do not cover everything. Floods, earthquakes, pest damage, and intentional acts are typically excluded.

Many renters don’t realize these exclusions until it’s too late. Additional coverage may be required depending on your location and risks.

7. Forgetting to Add High-Value Items

Items such as jewelry, watches, collectibles, art, or high-end electronics often have coverage limits. If these items exceed standard limits, you may need to add scheduled personal property coverage.

Failing to do so can result in partial reimbursement or claim denial.

8. Not Updating Coverage After Life Changes

Moving to a larger apartment, buying new furniture, or purchasing expensive items should trigger a policy update. Many renters keep the same coverage for years even as their lifestyle changes.

Outdated coverage may no longer reflect your actual needs.

9. Skipping an Inventory of Belongings

Without a home inventory, filing a claim becomes much harder. Renters who don’t document their belongings may struggle to prove ownership or value.

Photos, receipts, and digital records can significantly speed up claims and ensure fair payouts.

10. Assuming Renters Insurance Only Applies Inside the Apartment

Many renters don’t realize their insurance may cover belongings stolen outside the home, such as from a car, hotel room, or storage unit.

Not understanding this benefit leads renters to undervalue the protection they already have.

How to Avoid These Mistakes

Review your policy details carefully

Create a detailed inventory of belongings

Choose realistic coverage limits

Confirm liability protection is included

Update your policy annually or after major purchases

Being proactive ensures your renters insurance actually works when you need it.

Final Thoughts

Renters insurance is simple, affordable, and powerful—but only when used correctly. Avoiding these common mistakes can protect your belongings, finances, and peace of mind. A well-chosen policy turns unexpected disasters into manageable situations instead of financial emergencies.