Car insurance is not just a financial safety net — it’s a legal requirement in almost every U.S. state. Failing to carry the minimum required coverage can result in fines, license suspension, or even jail time. However, the minimum required coverage varies significantly from state to state. Understanding these requirements can help you stay legally compliant and financially protected.

Why Minimum Car Insurance Matters

Minimum car insurance requirements are set by state law to ensure that drivers can cover at least a basic level of financial responsibility in the event of an accident. These requirements typically include liability coverage for bodily injury and property damage, which pays for damages to others if you are at fault.

Meeting state minimums protects you legally and financially, but it doesn’t necessarily provide full protection — especially in serious accidents.

Types of Minimum Coverage

Most states require the following types of liability coverage:

- Bodily Injury Liability (BI): Pays for medical expenses, lost wages, and legal costs if you injure someone in an accident you caused.

- Property Damage Liability (PD): Covers repair or replacement costs for another person’s property, usually a vehicle.

Some states also require additional coverages such as:

- Personal Injury Protection (PIP): Covers medical costs for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist (UM/UIM): Protects you if the at-fault driver has no insurance or insufficient coverage.

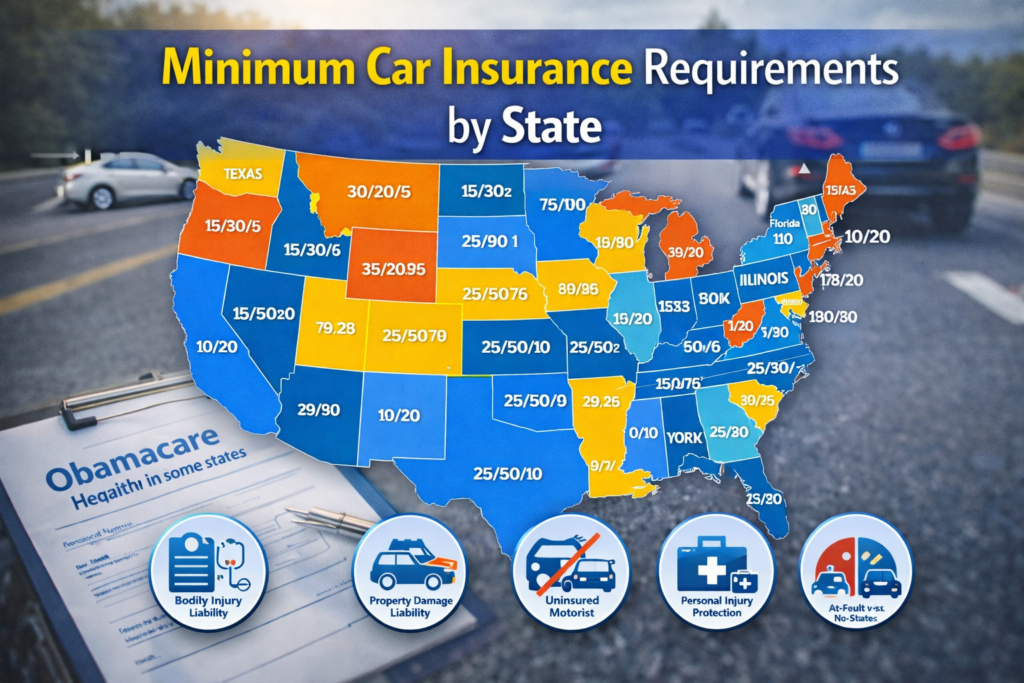

State-by-State Breakdown

Here’s how minimum car insurance requirements look in several states (amounts reflect minimums for bodily injury per person / per accident / property damage):

- California: 15/30/5

- Texas: 30/60/25

- Florida: 10/20 (PIP required)

- New York: 25/50/10

- Illinois: 25/50/20

- Pennsylvania: 15/30/5

- Ohio: 25/50/25

(Note: These figures are examples and may change — always check your state’s current requirements.)

No-Fault vs. At-Fault States

Some states operate under no-fault insurance systems, meaning your own insurance pays your medical expenses regardless of who caused the accident. These states typically require PIP coverage.

By contrast, at-fault states rely on the driver responsible for the crash to pay for damages through liability insurance.

Why Minimum Coverage May Not Be Enough

While meeting state minimums keeps you legal, it doesn’t guarantee adequate protection. In serious accidents, medical bills and property damage can far exceed minimum limits, leaving you personally responsible for the difference.

Consider purchasing higher liability limits or additional coverage such as:

- Collision and Comprehensive: Pays for your vehicle’s repairs regardless of fault (theft, weather damage, etc.)

- Medical Payments Coverage: Supplements PIP or covers medical costs if PIP isn’t available

- Rental Reimbursement: Pays for a rental car while yours is repaired

Penalties for Non-Compliance

Driving without minimum insurance can lead to serious consequences:

- Fines and court fees

- License suspension or vehicle registration revocation

- SR-22 requirements for high-risk drivers

- Possible jail time in extreme cases

How to Choose the Right Coverage

Assess your financial risk and consider factors such as:

- Value of your assets

- Frequency of driving and commute length

- State-specific risk factors (weather, accident rates)

- Cost vs. benefit of higher coverage limits

Using an independent agent or online comparison tools can help you find the best coverage at competitive rates.

Final Thoughts

Minimum car insurance requirements vary widely across the United States, but they all serve a common purpose: ensuring drivers can cover basic financial responsibilities after an accident. While meeting state minimums keeps you legal, choosing higher limits and additional coverages provides stronger financial protection and peace of mind.